indiana estate tax id number

If youre unsure contact the agency at 317. Search by address Search by parcel number.

Fafsa Checklist Fafsa Checklist Create Yourself

You may be asked to fax a signed document confirming that youre the executor or other estate-related.

. See Departmental Notice 2 for more information. State Form Number Description File Type. This legal identification which is also called an employer identification number EIN allows startups to open business bank accounts apply for loans and other essential tasks.

Though Indiana does not have an estate tax you still may have to pay the federal estate tax if you have enough assets. Provide the address of the estate and the estates bank account number. Median Property Tax In Indiana.

Search Adams County property tax and assessment records by parcel number name or address. For best search results enter a partial street name and partial owner name ie. Every year taxpayers contact local and State offices to find out their taxing district number a key piece of information for a personal property filing.

Median Home Value In Indiana. Homeland Security Department of. Every business selling tangible goods in Indiana will need a Registered Retail Merchant Certificate to buy goods at wholesale prices without paying sales tax and collect sales tax on goods sold.

So for example if you start a. Look Up Your Propertys Tax Assessment. In Line 1 enter the first name middle initial and last name of the decedent followed by the word Estate In Line 2 write NA which stands for non-applicable.

124 Main rather than 124 Main Street. The State of Indiana has. Specialists will review the information and file all of the paperwork for you.

Median Income In Indiana. As you may already know dealing with the IRS. Criminal Justice Institute.

An estates tax ID number is called an employer identification number or EIN and comes in the format 12. Effective June 1 2022 the gasoline use tax rate in Indiana for the period from June 1 2022 to June 30 2022 is 0240 per gallon. Indiana Property Tax Statistics.

In most cases an Indiana State Tax ID number would be the sales tax ID number. Claim for Refund - Inheritance and Estate. Getting an Indiana tax ID number a Trust Tax ID number or any other entity requires going through the IRS.

Estate Of Deceased Individual admin 2019-01-25T0959370000. Heres how to get one. Before filing Form 1041 you will need to obtain a tax ID number for the estate.

State Excise Police Indiana. The exemption for the federal estate. Federal Estate Tax.

Setting up your Indiana Tax ID can be easy. Be sure to have one. Corrections Indiana Department of.

The IN state sales tax ID number enables you to buy wholesale and sell retail. Home Indiana Estate Of Deceased Individual. In the event that someone dies and leaves behind money property or other assets the administrator or executor of the estate will need to obtain what is known as an Employer.

Jefferson St Suite 230 Decatur. Cut Through the Red Tape. You can find your Tax Identification Number on any mail you have received from the Department of Revenue.

Simply visit GovDocFiling and enter your information. Apply for a Tax ID EIN in Indiana. You may also need to complete the FT-1 application for motor fuel taxes including special fuel or.

A Indiana Federal Tax ID Number which is also known as an Employer ID Number EIN or Federal Tax Identification Number is a unique nine-digit ID assigned by the Internal Revenue Service for tax purposes for businesses as well as Non-Profit organizations Trusts and Estates. An estates tax ID number is called an employer identification number or EIN and comes in the. Law Enforcement Academy Indiana.

If you are opening a business or other entity in Indiana that will have employees will operate as a Corporation or Partnership is required to file employment. To register for Indiana business taxes please complete the Business Tax Application. An Estate in common law is the net worth of a person at any point in time.

Search for your property. Indiana Tax Identification Number. Before filing Form 1041 you will need to obtain a tax ID number for the estate.

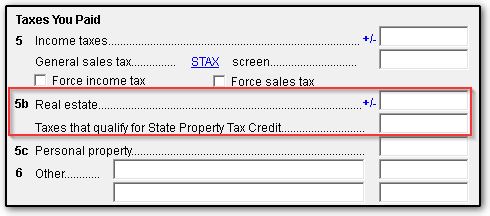

The New Age In Indiana Property Tax Assessment

State Corporate Income Tax Rates And Brackets Tax Foundation

5145 Fordon Ct Union Twp Oh Real Estate Indian Hill House Styles

One Page Lease Agreement Peterainsworth Lease Agreement Lease Agreement Free Printable Contract Template

Comparing The Real Cost Of Owning Property Across The United States Property Tax Real Estate Staging Denver Real Estate

The New Age In Indiana Property Tax Assessment

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Awesome Indiana Pacers Indiana Basketball Indiana

Free Indiana Tax Power Of Attorney Form 49357 Pdf Eforms

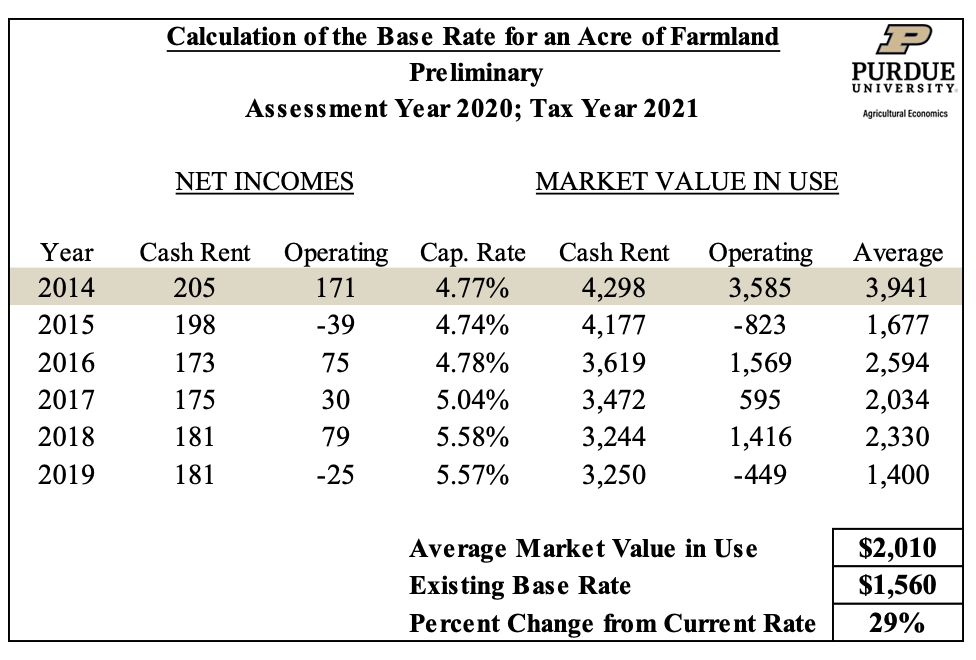

Farmland Assessments Tax Bills Purdue Agricultural Economics

Indiana Sales Tax Small Business Guide Truic

Register With Dor And Dwd Inbiz

How Long Does A Speeding Ticket Stay On Your Record D Turner Legal Llc Speeding Tickets Records Ticket

Louisiana Quit Claim Deed Form Quites Louisiana Louisiana Parishes